Frozen Bank Account Due to Unpaid Florida Sales Tax? A frozen bank account? When a taxpayer has unfiled returns or unpaid Florida sales tax, the Florida Department of Revenue has the authority to freeze their bank accounts to collect the owed amount. This process begins with a notice sent to banks, freezing funds across all accounts […]

Tax Forgiveness Programs: Timely Action Matters

Facing tax issues can feel overwhelming, especially for small business owners. However, timely action is crucial in navigating tax forgiveness programs and avoiding severe penalties. This article delves into effective tax resolution strategies, emphasizing the importance of prompt engagement with tax professionals. Discover how programs like Offer in Compromise and Currently Not Collectible can provide relief, and learn how to manage unfiled tax returns. With expert guidance, you can regain control of your financial situation and secure a brighter future for your business. Don’t let procrastination escalate your tax challenges—take the first step towards resolution today!

Understanding the Florida Sales and Use Tax Audit Process: What You Need to Know

Learn the key steps and strategies to manage a Florida sales and use tax audit effectively. Our guide explains the audit process, common pitfalls, and expert tips to help you navigate unexpected tax liabilities.

Understanding the Frustration of IRS Wage Garnishment: What to Expect

Understanding IRS Wage Garnishment: What to Expect Facing wage garnishment by the IRS is a challenging situation for any small business owner or individual. Garnishment of wages is a measure the IRS takes to recover unpaid taxes directly from your wages. What causes a wage garnishment? How does IRS garnishment work? And most importantly, how […]

Back IRS Taxes: Understanding Your Obligations and Options

Back taxes can cause a lot of stress for taxpayers. However, knowing your responsibilities and choices is the first step to finding a solution. Ignoring unpaid taxes can lead to serious consequences, including wage garnishment and tax liens. Fortunately, there are ways to manage tax debt effectively, from filing past-due returns to negotiating with the IRS. This guide will help you understand back taxes. It will explore options for relief. You will feel empowered to take control of your finances. Don’t let back taxes overwhelm you—discover the strategies that can lead to a brighter financial future.

Do IRS Payment Plans Have Interest? Here’s What to Know

Are you struggling to navigate the complexities of IRS payment plans? You’re not alone! Many taxpayers wonder if these plans come with interest and penalties. The truth is, IRS payment plans can help reduce your financial stress. They let you make smaller monthly payments. However, these plans do add interest and may have late fees. Understanding your options is crucial for maintaining financial health. From short-term plans to offers in compromise, there are various paths to explore. Discover how expert guidance can help you manage your tax obligations effectively and achieve peace of mind. Read on to learn more about your options!

Understanding IRS Form 433-D: A Step by Step Guide

Understanding IRS Form 433-D: A Step-by-Step Approach Navigating the complexities of tax forms can be daunting for small business owners. One such form, IRS Form 433-D, is crucial for managing tax liabilities effectively. This form is an installment agreement. It’s used to set up a payment plan for paying off tax debt. Understanding it can […]

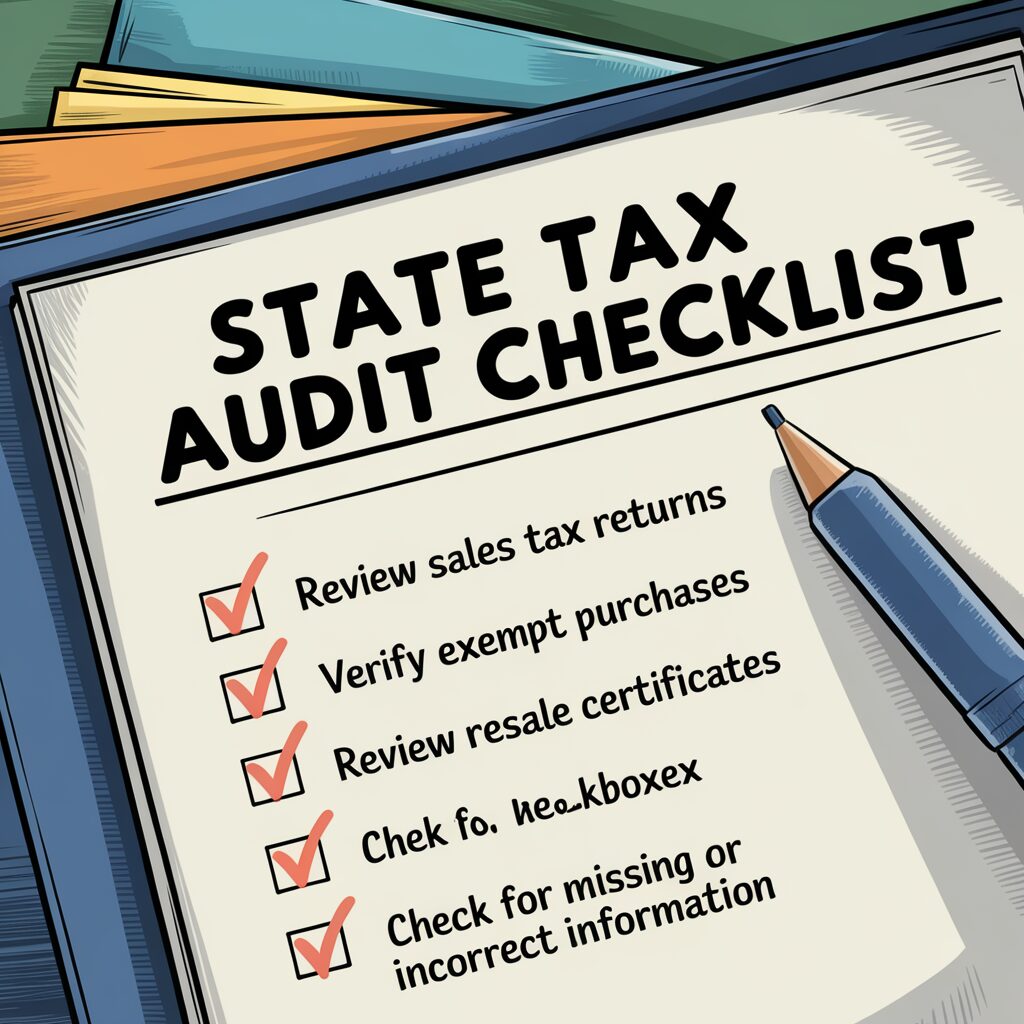

Essential Sales Tax Audit Checklist Items

Sales Tax Audit Checklist Understanding the intricacies of sales tax audits is not just about compliance; it’s about safeguarding your business’s financial health. An audit can seem scary. However, with a sales tax audit checklist and good preparation, it becomes easier to manage. This article will go through each step of the audit process. It […]

How to Stop IRS Wage Garnishment | Wage Levies for Back Taxes

Do you know the methods the IRS could use to collect your owed money via wage garnishment? To stop a wage garnishment for back taxes, you need a smart plan. This often means negotiating with the IRS and using certain legal options. Here’s a comprehensive overview of the steps and considerations to address this issue: Understand the […]

Overcoming IRS Hardship: Your Guide to Financial Resilience!

IRS hardship status is a way for individuals experiencing financial difficulties to seek relief from certain tax obligations. To qualify, you must provide sufficient evidence of your financial situation, such as income and expense details. This information helps the IRS assess whether you are unable to pay your taxes in full without causing undue hardship. Additionally, you may need to demonstrate that you have explored other options, like installment agreements or offers in compromise, before requesting hardship status. The IRS carefully reviews each case on an individual basis to determine eligibility, aiming to provide assistance to those in genuine need.